|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

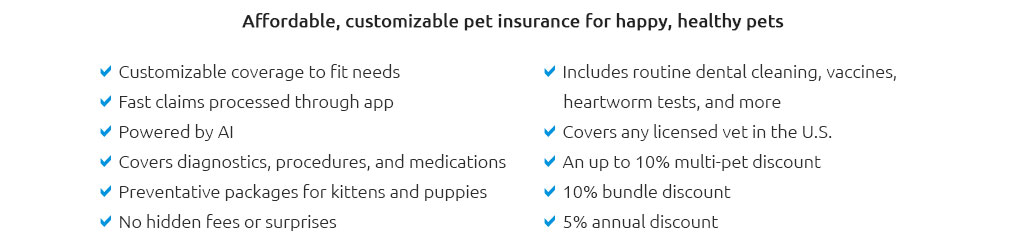

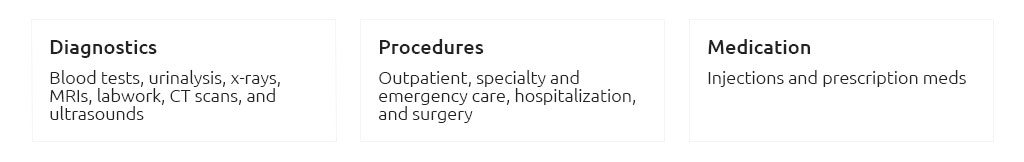

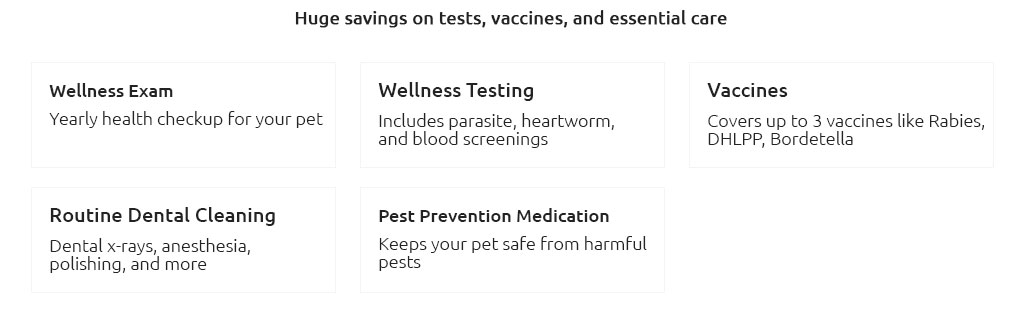

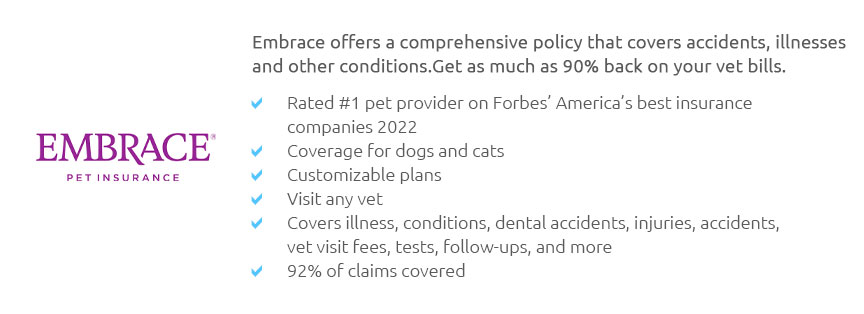

Understanding Pet Insurance: What It Covers for Vet VisitsIn an age where pets are considered an integral part of the family, ensuring their health and well-being becomes paramount. As pet ownership grows, so does the interest in pet insurance, a tool that many pet owners find invaluable when it comes to managing veterinary costs. But what exactly does pet insurance cover when it comes to vet visits? This question is crucial for pet owners trying to decide whether investing in a policy is the right decision for their furry companions. First, it's essential to understand that pet insurance is not a one-size-fits-all solution. Policies can vary widely between providers, and even within a single company, there may be multiple plans with different levels of coverage. However, most pet insurance policies generally cover a range of services related to vet visits. These typically include accidents and illnesses, which are the backbone of most pet insurance plans. Accidents might cover anything from broken bones to ingestion of foreign objects, while illnesses might include both minor infections and more serious conditions like cancer or diabetes. Furthermore, some pet insurance plans offer coverage for routine care or wellness visits, although this is not universal. Routine care usually encompasses regular check-ups, vaccinations, flea and tick prevention, and sometimes dental cleanings. These preventive measures are crucial for maintaining a pet's health and can help catch potential issues early. It's worth noting, however, that such coverage often comes with additional premiums or as add-ons to standard policies. One key benefit of pet insurance is the financial security it provides during unexpected health crises. Veterinary bills can be exorbitant, especially for emergency surgeries or ongoing treatments for chronic conditions. With pet insurance, owners can focus more on the best course of treatment rather than the cost, knowing that a significant portion of the expenses will be covered. This peace of mind is invaluable, reducing the stress associated with pet health emergencies. It's important to be aware of the limitations and exclusions that might come with a policy. Pre-existing conditions are typically not covered, so it's advantageous to enroll pets in insurance while they are still young and healthy. Additionally, certain breeds that are prone to specific hereditary conditions might face limitations in coverage. Therefore, reading the fine print and understanding the terms of the policy is imperative to avoid unpleasant surprises down the line. In conclusion, while pet insurance can be an excellent tool for managing veterinary costs, it requires careful consideration and understanding of what is covered. Owners should weigh the benefits of potential savings against the cost of premiums and choose a plan that aligns with their pet's needs and their financial situation. By doing so, they can ensure that their beloved pets receive the best possible care without the burden of overwhelming vet bills. https://www.everypaw.com/cover-explained/what-does-pet-insurance-cover

Pet insurance typically covers vet visits for unexpected accidents or illnesses. This includes consultations, examinations, and any necessary diagnostic tests ... https://www.lemonade.com/pet/explained/does-pet-insurance-cover-vet-visits/

Emergency vet visits can be costly, but they are often covered under accident and illness pet insurance plans. With Lemonade, you can have the diagnostics, ... https://www.quora.com/Does-pet-insurance-cover-regular-vet-visits

It depends on the insurance carrier and the extent of the policy in force. The current policy I have on one of my dogs which does not cover regular office ...

|